DOGE Price Prediction: Technical Breakout and Institutional Momentum Target $0.35-$1.00

#DOGE

- Technical breakout above Bollinger Bands with strong momentum indicators

- Institutional accumulation nearing $1 billion treasury target supporting price floor

- ETF speculation and potential approval creating long-term bullish catalysts

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Breakout Potential

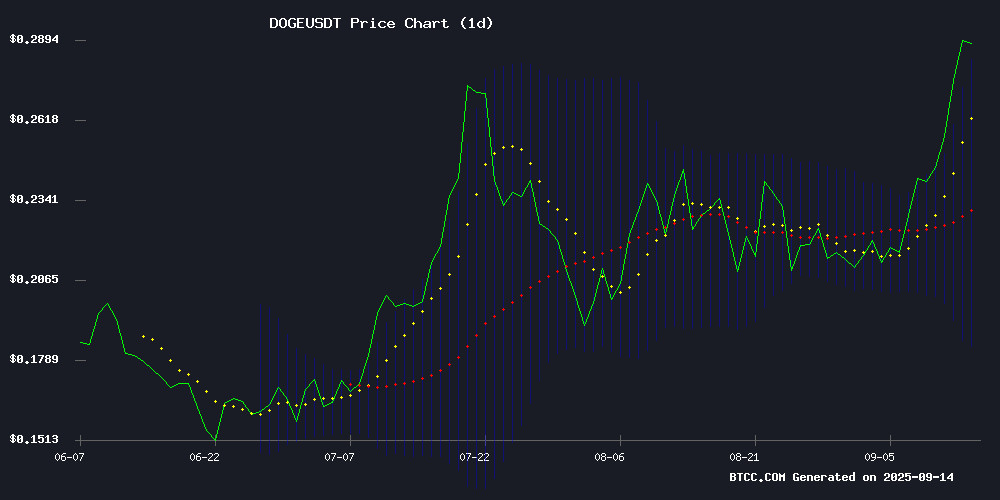

DOGE is currently trading at $0.28748, significantly above its 20-day moving average of $0.23311, indicating strong bullish momentum. The MACD reading of -0.018798 remains negative but shows improving momentum with the histogram at -0.012772. Most notably, Doge has broken above the upper Bollinger Band at $0.282564, suggesting potential overbought conditions but also signaling strong buying pressure. According to BTCC financial analyst James, 'The breach above the upper Bollinger Band, combined with price trading well above the 20-day MA, indicates sustained bullish sentiment. However, traders should watch for potential pullbacks to the middle band around $0.233 as healthy consolidation levels.'

Market Sentiment: Institutional Interest and ETF Speculation Drive Optimism

Current news FLOW surrounding DOGE reflects overwhelmingly positive sentiment, driven by institutional accumulation and ETF speculation. CleanCore's approaching $1 billion treasury target with recent $130 million purchases demonstrates significant institutional confidence. Multiple headlines project price targets ranging from $0.30 to $1.00 by year-end, with technical breakouts and ETF buzz creating substantial momentum. BTCC financial analyst James notes, 'The combination of institutional buying, technical breakouts, and ETF speculation creates a powerful bullish narrative. However, the ETF launch delay has introduced some near-term uncertainty, though the 4% surge despite this news shows underlying strength.' The market appears to be pricing in both technical momentum and fundamental developments, though overbought conditions warrant cautious optimism.

Factors Influencing DOGE's Price

DOGE Price Prediction: Dogecoin Eyes $0.35 Target Despite Overbought Conditions

Dogecoin's bullish momentum continues to defy overbought signals, with technical analysis suggesting a potential test of the $0.35 resistance level within two weeks. The meme cryptocurrency shows remarkable resilience, though traders should note the RSI warning of a possible pullback to $0.26 support before any sustained upward movement.

Market sentiment remains divided between short-term profit-taking opportunities and longer-term bullish expectations. The $0.35 target represents a significant psychological barrier that could determine DOGE's trajectory through the end of the quarter.

CleanCore Nears $1B Dogecoin Treasury Target with $130M Purchase

CleanCore Solutions has crossed the halfway mark in its plan to amass a 1 billion Dogecoin treasury, acquiring over 500 million DOGE. The latest $130 million purchase underscores the company's aggressive positioning in the meme-inspired cryptocurrency.

The move comes as institutional interest in Dogecoin grows, despite delays in the launch of the first spot DOGE ETF. CleanCore's strategy aims to secure 5% of DOGE's circulating supply, framing it as both a reserve asset and a payments vehicle.

"This accelerates Dogecoin's path to becoming a premier cryptoasset," said Marco Margiotta, CleanCore's CIO and CEO of House of Doge. The treasury plan targets utility across remittances, tokenization, and staking-like products.

Dogecoin Breaks Key Trendline as Bulls Target $0.97 Amid Bullish Technicals

Dogecoin has shattered a critical ascending trendline, signaling a potential bullish phase with technical targets ranging from $0.41 to $0.97. The breakout coincides with Bollinger Band expansion, historically a precursor to 20-30% rallies within 30 days.

Market dynamics align with favorable conditions for speculative assets. Softening U.S. industrial production data and persistent hawkish monetary policy are driving capital toward alternative investments. Dogecoin's high-volume breakout mirrors patterns identified in peer-reviewed crypto market research as reliable momentum indicators.

Dogecoin Breaks Out: Is $0.50 Next for the Meme King?

Dogecoin has emerged from a multimonth symmetrical triangle, a technical pattern often signaling continuation and momentum. Trading volume tripled during the breakout, suggesting institutional interest rather than retail speculation. The coin currently trades around $0.29, with analysts projecting a potential rise to $0.60 by October—a 95% gain. More conservative estimates still target $0.45, aligning with the upper boundary of a longer-term pattern.

Critical support levels include the 50-week EMA at $0.227. A weekly close below this level could trigger a swift decline toward the 200-week EMA near $0.215. Momentum indicators remain favorable, with RSI showing room for further upside before overbought conditions emerge.

On-chain metrics suggest the rally hasn't yet reached excessive levels, leaving potential for continued growth. The $1 price target for this cycle remains within the realm of possibility.

New Crypto Investors Favor Remittix Over Dogecoin in 2025 Amid Shift to Utility-Based Projects

The 2025 cryptocurrency market is witnessing a divergence between meme-based tokens and utility-driven projects. Dogecoin, priced at $0.2713 with an 8.18% daily gain, retains its cultural cachet and $40.74 billion market cap. Yet its $4.24 billion trading volume underscores the volatility that's pushing investors toward solutions like Remittix.

Remittix has raised $25.3 million in presale at $0.1080 per token, selling 659.1 million tokens. Its blockchain-to-bank transfer proposition contrasts sharply with Dogecoin's speculative appeal, reflecting broader demand for functional crypto applications.

Dogecoin Targets $0.30 as Breakout and ETF Buzz Lift Momentum

Dogecoin (DOGE) is exhibiting renewed bullish momentum, trading near $0.249 and testing the upper boundary of its six-week consolidation range between $0.22 and $0.25. A breakout above this level could propel the meme coin toward higher targets, with traders eyeing $0.30 as the next key resistance.

Technical indicators reinforce the optimistic outlook. The 20-day exponential moving average (EMA) has risen to $0.225, converging with the 50-day, 100-day, and 200-day averages clustered just below $0.220. This alignment forms a robust support base. The relative strength index (RSI) hovers between 60 and 61, signaling steady demand without overbought conditions, while the MACD histogram has flipped positive, underscoring growing bullish sentiment.

A decisive close above the $0.246–$0.250 resistance zone could open the door to $0.263, followed by $0.273–$0.276, potentially retesting July's peak near $0.30. Analysts note a parallel channel pattern on the daily chart, with a breakout above $0.29 possibly fueling a rally toward $0.50.

DOGE’s Explosive Surge: Will It Skyrocket to $0.45?

Dogecoin (DOGE) surged 8.99% in 24 hours to $0.2833, backed by a $5.21 billion trading volume. The meme coin has climbed 31.73% over the past week, reflecting sustained bullish momentum and growing investor confidence.

Trading volume spiked 18.77% to $10.57 billion, signaling intensified market interest. Analysts note DOGE is entering a potential wave-3 bullish phase, with a successful trendline retest likely confirming further upside. The cryptocurrency's technical structure suggests room for continued growth, though traders remain watchful for corrective movements.

Dogecoin ETF Launch Delay Sparks Market Speculation as DOGE Price Rally Cools

Dogecoin's recent price surge faced headwinds as Bloomberg ETF analyst Eric Balchunas confirmed a second delay for the anticipated DOGE ETF, now expected next Thursday. The memecoin had rallied 27% to $0.27 this week amid mounting ETF speculation, marking its third bullish attempt this year to break the $0.30 resistance level.

Market participants speculate the postponement may align with next week's FOMC rate decision. Technical indicators suggest DOGE entered overbought territory during Friday's peak, with traders now weighing potential profit-taking against renewed ETF enthusiasm. Historical patterns show previous DOGE rallies faltered near current price levels.

Dogecoin Surges 20% Amid Institutional Buying and ETF Speculation

Dogecoin (DOGE) rallied nearly 20% this week to $0.25, marking its strongest performance since mid-August. The surge follows CleanCore Solutions' disclosure of additional DOGE purchases, pushing its holdings above 500 million tokens—a $125 million position at current prices. The NYSE American-listed firm has partnered with the Dogecoin Foundation's commercial arm to position DOGE as a reserve asset for payment systems and tokenization projects.

CleanCore's stock (ZONE) rose 6% this week and has gained over 200% year-to-date, reflecting market confidence in its crypto strategy. Meanwhile, speculation grows around a potential U.S. Dogecoin ETF, with investors closely watching regulatory developments.

Dogecoin Price Forecast: Explosive Rally Toward $1 by Year-End

Dogecoin surged 7.14% to $0.2802, pushing its market capitalization to $42.29 billion amid growing speculation about a potential ETF approval. Whale activity intensified, with 280 million DOGE accumulated in 24 hours, signaling strong institutional interest.

Derivatives markets mirrored the bullish sentiment, with open interest rising 12.11% to $5.39 billion and trading volume hitting $9.96 billion. Technical analysts identify $0.30 as the next key resistance level, with a breakout potentially accelerating gains toward $1 by year-end.

The rally stems from three converging factors: renewed ETF optimism, aggressive whale accumulation, and favorable chart patterns. Market participants increasingly view DOGE as a legitimate candidate for ETF approval following Bitcoin's regulatory milestones.

Dogecoin Defies ETF Delay with 4% Surge Amid Institutional Interest

Dogecoin's price climbed to $0.26 despite a one-week postponement of the Rex-Osprey DOGE ETF, originally slated for September 12. Market resilience overshadowed regulatory uncertainty as institutional players like CleanCore Solutions and Thumzup doubled down on DOGE allocations.

The SEC's opaque delay follows a pattern of crypto ETF backlog management, yet traders treated the news as a non-event. Bloomberg's Eric Balchunas noted the postponement lacked justification, leaving room for speculation about the agency's stance on meme-based financial products.

How High Will DOGE Price Go?

Based on current technical indicators and market sentiment, DOGE shows strong potential for further upside movement. The breakout above key resistance levels and sustained institutional interest suggest price targets between $0.35 and $0.45 in the near term, with more optimistic projections reaching $0.97 to $1.00 by year-end.

| Timeframe | Price Target | Key Drivers |

|---|---|---|

| Short-term (1-4 weeks) | $0.35 - $0.45 | Technical breakout, ETF speculation |

| Medium-term (1-3 months) | $0.50 - $0.70 | Institutional accumulation, market momentum |

| Long-term (By year-end) | $0.97 - $1.00 | ETF approval, broader adoption |

BTCC financial analyst James emphasizes that while the technical setup appears strong, 'Traders should monitor the $0.233 support level and be aware that overbought conditions may lead to short-term consolidation before further advances.'